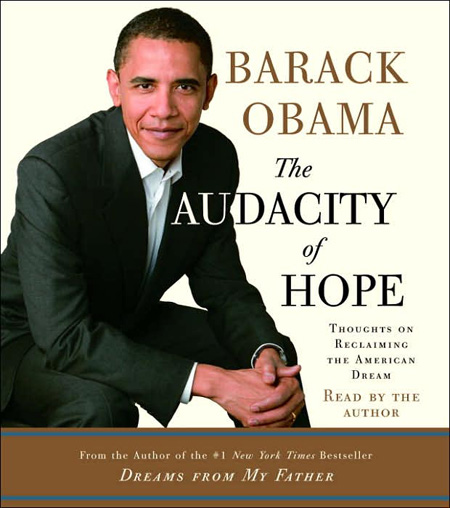

I purchased an audiobook today through Audible.com, which incidentally was the first time I have used the site or purchased an ebook. The process was simple enough, but the whole DRM thing annoys me (thankfully Tunebite helped with that).

I purchased an audiobook today through Audible.com, which incidentally was the first time I have used the site or purchased an ebook. The process was simple enough, but the whole DRM thing annoys me (thankfully Tunebite helped with that).

Getting to the point, the audiobook I purchased was Barack Obama’s “The Audacity of Hope”. Why? Well the main reason for buying the audiobook was that I think he is one of the greatest orators I have heard in a long time. Rupert was right, he does have a level of rock star appeal.

On a more serious level he fascinates me for a number of reasons. The main reason is that he is such a mixture of backgrounds, some say a “a neutral persona on whom people can project their personal histories and aspirations”. This is partially because his background is so diverse that almost anyone can find something in common; a Kenyan father, an American mother, born in Honolulu, grew up in Jakarta, Hussein as a middle name and a first name based on the Hebrew word baruch (blessed).

The more critical factor is that people claim that he just ‘clicks’ with them, and for some reason he clicks with me too. How is it possible to do this across such a wide audience? Will connecting with everyone mean that eventually some people are going to feel betrayed? Quite possibly. I guess he just has to walk the rock star line and keep performing to the people in the hope that he eventually hits number 1.